An early 2018 survey conducted by the Global Blockchain Business Council revealed that 60% of Americans have heard of Bitcoin, while only a mere 5% actually own the popular digital asset. Feels low based on media coverage, right? And even further – how many of those people can really explain Bitcoin? No need for survey results to tell you: not many. While I’m not an expert, I do find the technology and resulting ecosystem interesting and exciting – so here is my best shot at simplifying a complicated subject and an emerging industry.

Bitcoin is a digital currency that utilizes blockchain technology. Wait. Stop. Blockchain? Yep. Blockchain is effectively a decentralized database containing a collection of records that is validated and maintained by a wider community, versus a single entity or authority (thus decentralized). Aptly named, each “block” represents a number of transactional records which are linked together by a “chain” using a specific hash function (a fancy term that just means mapping data of arbitrary size to a fixed size). SHA-256 is a cryptographic secure hash function that was originally developed by the National Security Agency (NSA) and is used in several different parts of the Bitcoin mining network because of its security advantages (never been compromised! … knock on wood). Nodes are said to be “mining” Bitcoin – not a helpful or intuitive description, but don’t let the unfamiliar terminology discourage you from visualizing the process. A node is simply a computer that is connected to the network and acting as an administrator of the blockchain. When a node is mining, a computer is competing to solve computational puzzles in order to validate a transaction. Once solved, the record is confirmed by the distributed network of computers and added to the blockchain becoming, henceforth, immutable. The miner’s reward for all that hard work? A (portion of a) shiny new Bitcoin, of course! A valuable snippet of code that represents a digital concept. Thanks, Satoshi Nakamoto, whoever you are.

I said a Bitcoin is valuable, but why? How is its value quantified, when it seemingly has no intrinsic value? A good question that deserves a better answer. Here it goes…

Chris Burniske’s book is awesome and describes how some conventional economic principles can be used in valuing digital assets, so let’s not reinvent the wheel and use some of his research. Digital assets have value just as traditional assets have value, yet they don’t generate cash flows. Therefore, we need to use an appropriate proxy for the future free cash flow used in a standard discounted cash flow (DCF) analysis – enter the ‘equation of exchange’. The ‘equation of exchange’ states that M x V = P x Q where:

- M = money supply (or size of the asset base)

- V = velocity of money (or how frequently an asset is exchanged)

- P = average not current price level of good (or the average price of a substitute)

- Q = number of transactions (or the number of transactions of a substitute)

Using basic algebra, we rewrite the equation such that that M = (P x Q) / V. Think of (PQ) just as you would think of the GDP of an economy. Solving for M allows us to quantify the size of the asset base required to support a digital asset’s economy at a stated velocity. Lastly, we still need to discount future utility back to the present. Most rate assumptions I’ve seen are in the 30-50% range, which is much higher than even a risky equity and more in-line with an early-stage investment made by a venture capital firm.

For a significantly more detailed look at Chris’ methodology, check out his model here.

Note: this methodology is logical and the most widely accepted, but it certainly doesn’t paint the entire picture, as many assumptions still must be made. Detailed quantitative analysis needs to be performed using a larger amount of historical data (only a small amount exists!) to discern more concrete valuation techniques. I suspect one day an academic will be awarded a Nobel Prize for his or her breakthrough research in digital asset valuation… but not today. For now, we might be just as likely to succeed at quantifying value by monitoring the prevalence of worldwide money laundering as indicated by a Swiss government watchdog (mostly kidding).

OK – we just covered utility valuation, but we’re missing a key piece to the crypto pricing puzzle: SPECULATION. What is speculation – call it potential utility value? I’ll show you.

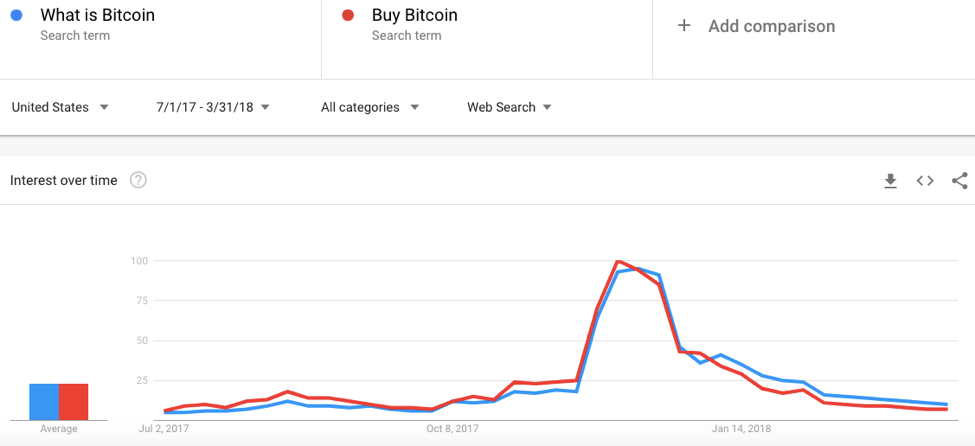

There it is! Why do I think the December 2017 price surge was speculative? Well…other than that the previously described utility valuation method indicated that Bitcoin was overpriced at the time, take a look at the below Google Trends graph I pulled, revealing the number of people searching Google for the answer to the questions “what is Bitcoin?” and “buy Bitcoin?” over the same time period. Look familiar? The eye test can identify a positive correlation, so let’s skip the regression (though I get it – correlation does not always imply causation– but it sure makes sense to me). Do people who buy Apple (AAPL) stock have to “Google it” right before purchasing? I doubt it. Speculation and lack of knowledge led the general public to believe that everyone could simply get rich quick.

While Bitcoin (BTC) often experiences large price swings relative to a traditional equity, it’s arguably the most stable digital asset. There are over 1,500 different cryptocurrencies trading on hundreds of different exchanges and only the top 20 digital assets make up ~90% of the total market capitalization! In general, financial markets are most efficient when price discovery is transparent and assets are liquid, so when much of the crypto marketplace remains unregulated, fragile, fragmented, and filled with “dumb money” (not my term), the potential for extreme volatility exists.

Price movement based on speculation is deceiving, and it drove the prices of less stable assets wild during the December crypto craze. The illogical economics of short-term potential utility value severely outweighed the actual utility value derived from remittances in the network (for currency) or the substitution of a resource that was being provisioned by a crypto network on its blockchain. Examples?

Stellar (XLM)

TRON (TRX)

Cardano (ADA)

Dragonchain (DRGN)

… and the list goes on, but you get it. The prices of digital assets the last few months have been more “stable”, but the debate about the value of Bitcoin and other digital assets rages on. I understand critics’ skepticism about Bitcoin as a currency – it’s unstable and its processing time is slow… and even with the creation of the Lighting Network, complications remain. In the long run, Bitcoin is more likely a storage of value (like gold) than an actual currency. What I do believe in is the power of the blockchain and the socio-economic value of a decentralized system that can reduce costs and create transparency for the appropriate applications.

… and the list goes on, but you get it. The prices of digital assets the last few months have been more “stable”, but the debate about the value of Bitcoin and other digital assets rages on. I understand critics’ skepticism about Bitcoin as a currency – it’s unstable and its processing time is slow… and even with the creation of the Lighting Network, complications remain. In the long run, Bitcoin is more likely a storage of value (like gold) than an actual currency. What I do believe in is the power of the blockchain and the socio-economic value of a decentralized system that can reduce costs and create transparency for the appropriate applications.

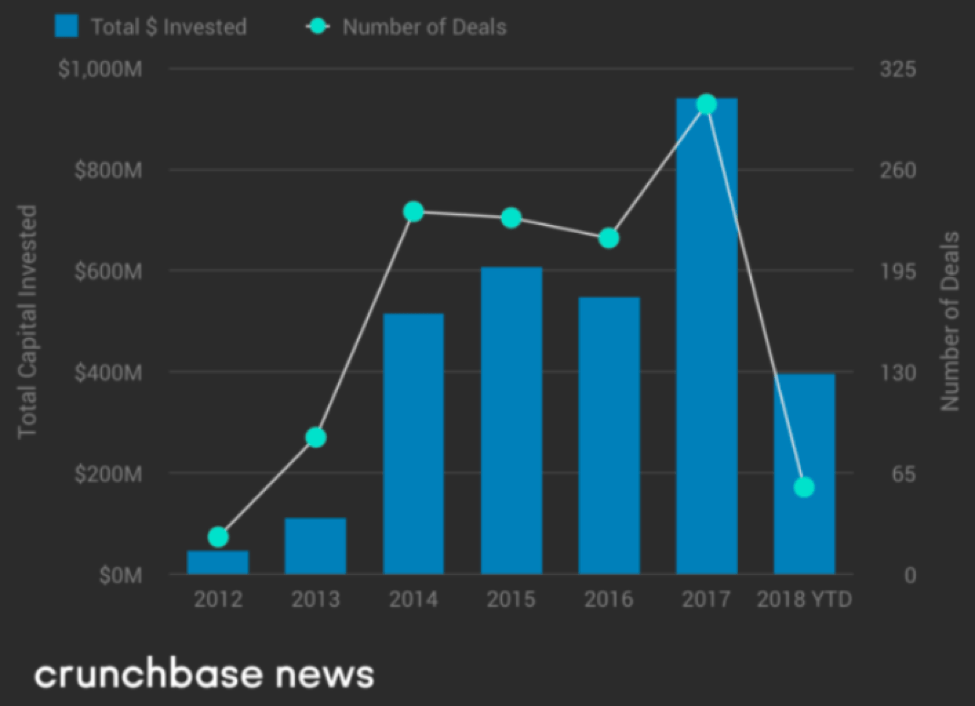

If you don’t agree, that’s perfectly OK, you’re not alone, but many in the venture community stand on my side of the divide. Venture support shouldn’t come as a surprise – it’s in the DNA of venture capital to find and promote disruptive technology, and blockchain technology has the potential to disrupt a wide range of industries, including banking, real estate, healthcare, legal, politics, and education…just to name a few. Without including the increasingly popular Initial Coin Offering (ICO) money, the below graph indicates that venture investments in blockchain-focused startups in just the first two months of 2018 totaled ~40% of the total 2017 capital raised.

Whether you’re a believer in blockchain technology and the birth of a new asset class, or believe that this entire movement is just a scam, it is impossible to deny that we are living through an exciting time that challenges the power of a central authority. Right or wrong – opportunities exist, established processes will be tested, and fortunes will be made and lost – and I, for one, can’t wait to see how the intersection of technology, economics, and human psychology comes together.

For a very long time everybody refuses and then almost without pause everyone accepts.

– Gertrude Stein